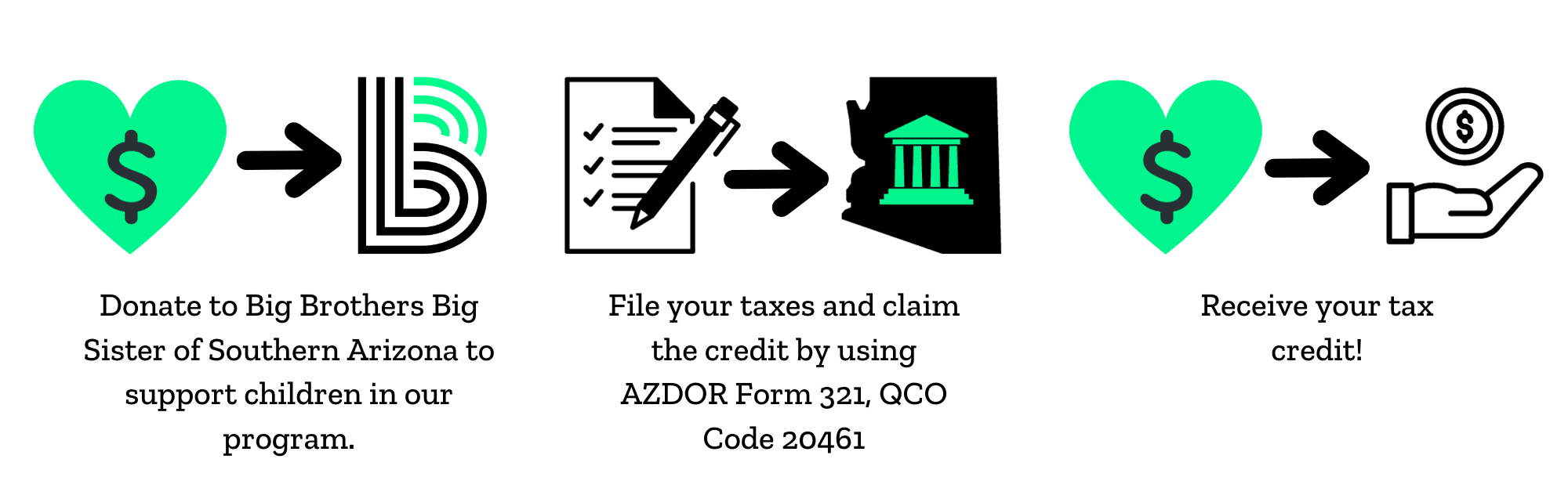

GIVE LOCAL, KEEP LOCAL WITH THE ARIZONA CHARITABLE TAX CREDIT.

RECEIVE AN AZ TAX CREDIT THAT CAN BE APPLIED TO 2023 OR 2024 WHEN YOU DONATE BY APRIL 15TH, 2024.

You can still donate before April 15th, 2024 that can be applied to your 2023 tax obligation. Donate up to $421 if you file single or up to $841 if you file jointly on your Arizona tax return. YOU DECIDE how your Arizona tax dollars are spent, so keep them right here in Tucson and help ignite the potential in the lives of children in need. EVERY DOLLAR HELPS ignite potential in youth through one-to-one mentoring with a caring adult. EVERY GIFT, large and small, is appreciated and put to good use where needed most.

The QCO has changed for 2024

The maximum QCO credit for 2024 is $470 single, married filing separate or head of household; $938 for married filing joint.

Please note: Arizona law allows QCO donations made during 2023 or donations made from January 1, 2024, through April 15, 2024, to be claimed on the 2023 Arizona income tax return. The maximum credit that can be claimed on the 2023 Arizona return for donations made to QCO's is $421 for single, married filing separate or head of household taxpayers, and $841 for married filing joint taxpayers. If a taxpayer makes a QCO donation from January 1, 2024, through April 15, 2024, and wants to claim the higher 2024 maximum credit amount, the taxpayer will need to claim the credit on the 2024 Arizona return filed in 2025.

The last day to postmark or make online gifts to be applied to the 2023 Arizona State Tax return, is April 15th, 2024 – or as adjusted by the IRS – for Arizona Charitable Tax Credit-qualifying contributions credited to the previous calendar year.